California Local Control Funding Formula (LCFF)

Today more than one in five children in California live in poverty and one quarter of California’s K-12 students are English learners. Poor students, African-Americans and Latinos, and English learners are over-represented among students scoring at the lowest levels and under-represented among the highest scoring. These achievement gaps between poor and non-poor and among various ethnic groups have over several decades been the catalyst for many laws and education reforms.

School board members have long been urging the state to let them use resources in a way that best fits local needs to help improve student outcomes. In June 2013, the California Legislature approved and Gov. Jerry Brown signed into law a historic reform of public K-12 education finance. Based on equity, transparency, accountability and local governing board authority, the Local Control Funding Formula (LCFF) transformed the distribution of funding to school districts, charter schools and county offices of education in a manner that grants local communities greater autonomy to customize education program offerings in purposeful ways for the entire student population generally, yet specifically for those students who are English learners, from low-income families, and those who are foster youth.

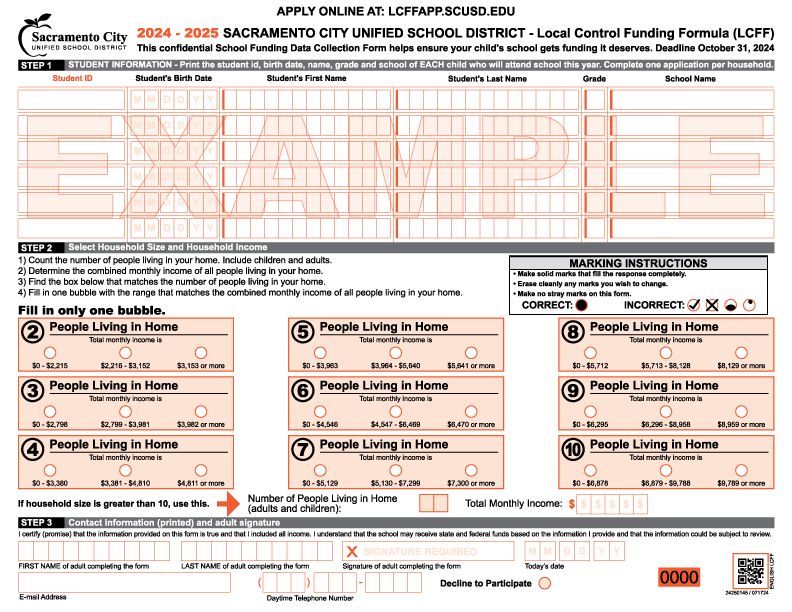

Eligibility based on an NSLP application or alternative income form.

To be included in the LCFF unduplicated student count, an NSLP application or alternative income form must be submitted by students to their schools by October 31 of the school year. For example, a student who submits an application on October 31, 2022 may be included in the 2022–23 LCFF unduplicated student count, if found to be eligible for FRPM. Applications submitted by October 31 may be processed and approved by the LEA after October 31 and students found to be eligible may be included in that year. Although students may be considered eligible for free/reduced price lunch programs in the first 30 days of a school year based on the prior year’s eligibility, students may not be coded as FRPM-eligible based on this 30-day eligibility window.

LEAs may begin to collect alternative income forms for the next school year during the preceding spring, to allow LEAs to incorporate the submission into the registration process, provided the USDA income eligibility guidelines are available. Since the forms reflect students’ income status for the next school year, and since CALPADS automatically closes all FRPM program records (181, 182) at the end of the school year, eligibility based on forms collected during the spring of the previous school year, must have a corresponding FRPM record submitted to CALPADS with a start date of July 1 or after.

For these students to be included in the unduplicated count, LEAs must submit an open program record with a Free Meal program code of 181 or a Reduced-Price Meal program code of 182 with a start date from July 1st through October 31st. LEAs may update CALPADS with FRPM program records until the close of the CALPADS Fall 1 amendment window, which is generally in late January or early February. (Specific dates are posted on the CALPADS web page.)

LEAs are required to verify a percentage of NSLP applications by November 15 of each year. If it is discovered during the income verification that a student should not have been designated as FRPM eligible, then the LEA must submit a correction to the FRPM record during the amendment period. Unless an error is discovered during the verification process, student eligibility is valid for the remainder of the school year, even if household circumstances change at a later date.

LEAs (in the case of alternative income forms) and food service departments (in the case of NSLP forms) may allow auditors access to individual forms for review, either for NSLP audits or LCFF audits. However, all documentation and information related thereto provided by the LEA staff (including any food services staff) to auditors is to be kept in strict confidence adhering to all state and federal privacy laws and is to be used solely for the purpose of determining whether a student is correctly designated as FRPM eligible.

LEAs (in the case of alternative income forms) and food service departments (in the case of NSLP forms) have the discretion whether to allow auditors to leave the campus with the forms, make copies, or have the forms or copies e-mailed or mailed off campus. Further, auditors may be required to review the forms onsite to maintain confidentiality, even if the auditor wants an additional sample of forms and has already left the campus.

Rocketscan and Image One can help you create, scan, and provide an audit CD to the auditor's to streamline and simplify this process. We strive to get you the greatest return for a fraction of the man hours needed to do this process by hand. Let Rocketscan help your district now!